Table of Contents

India Stock Challenge: The Ultimate Virtual Trading Experience

Master the art of stock market investing through realistic simulation and competitive challenges

India Stock Challenge Overview 📈

TheIndia Stock Challengerepresents a revolutionary approach to financial education through gamification. This innovative platform transforms complex stock market concepts into an engaging, interactive experience that appeals to both novice investors and seasoned traders.

💡 Did You Know?The India Stock Challenge has helped over 500,000 users understand market dynamics without risking real capital.

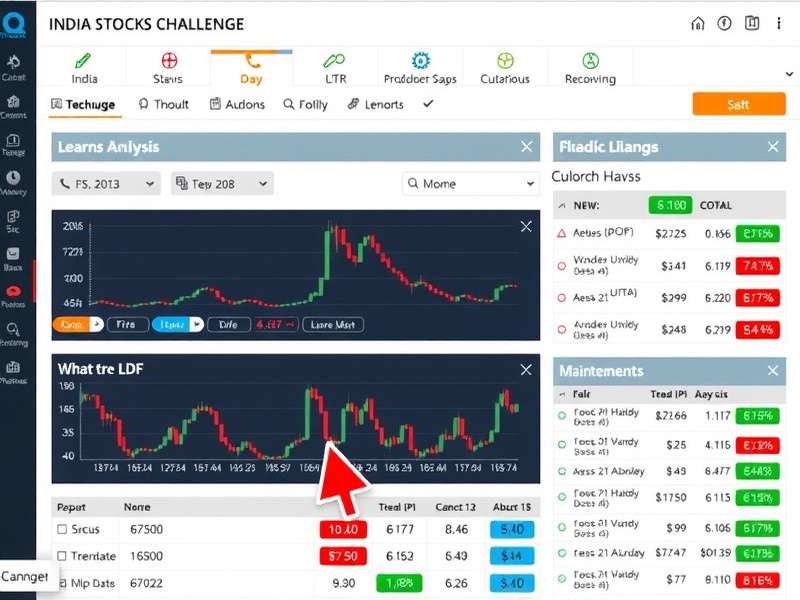

Unlike traditional investment games, theIndia Stock Challengeincorporates real-time market data, advanced analytical tools, and social trading features that create an immersive learning environment. Participants can test various investment strategies while competing against peers in a risk-free setting.

The platform's sophisticated algorithm mirrors actual market conditions with remarkable accuracy, providing users with valuable insights into price movements, volatility patterns, and trading psychology. This realistic simulation makes the India Stock Challenge an invaluable tool for anyone interested in understanding financial markets.

What sets the India Stock Challenge apart is its focus on the unique characteristics of the Indian stock market. The game includes stocks from major Indian indices like Nifty 50 and Sensex, along with sector-specific analysis tools tailored to India's economic landscape.

Key Features of India Stock Challenge 🎮

Real-Time Market Data

Access live streaming quotes, historical charts, and technical indicators that mirror actual market conditions with 15-minute delayed data.

Competitive Leaderboards

Compete against players nationwide with real-time ranking updates and monthly championship tournaments with exciting prizes.

Social Trading Network

Connect with other traders, share strategies, and learn from top performers through integrated social features and discussion forums.

Educational Resources

Comprehensive learning modules covering fundamental analysis, technical analysis, derivatives trading, and risk management strategies.

🌟 Unique Aspect:The India Stock Challenge incorporates behavioral finance principles to help users identify and overcome common psychological biases that affect trading decisions.

Additional features include portfolio analytics, risk assessment tools, news integration from financial publications, and customizable watchlists. The platform's intuitive interface makes complex financial data accessible to users of all experience levels.

Advanced users will appreciate the sophisticated charting capabilities, multiple timeframe analysis, and backtesting functionality that allows for strategy validation against historical market data.

Gameplay Mechanics 🕹️

Getting Started with India Stock Challenge

New participants begin their India Stock Challenge journey with a virtual capital of ₹1,000,000. This substantial starting amount allows for meaningful portfolio diversification and realistic position sizing.

The trading interface replicates professional brokerage platforms with order types including market orders, limit orders, stop-loss orders, and bracket orders. This variety enables users to implement sophisticated trading strategies.

Trading Sessions and Market Hours

The India Stock Challenge operates during actual market hours (9:15 AM to 3:30 PM IST) with pre-market and post-market simulation for comprehensive trading experience. Weekend challenges feature special scenarios and historical market recreations.

📊 Performance Metrics:Your portfolio is evaluated based on multiple parameters including absolute returns, risk-adjusted returns, maximum drawdown, and Sharpe ratio.

Asset Classes Available

Participants can trade across multiple asset classes within the India Stock Challenge:

- Equities:Over 500 stocks from Nifty 500 index

- Derivatives:Futures and options on major indices and stocks

- ETFs:Various exchange-traded funds tracking different sectors

- Mutual Funds:Select mutual fund schemes for long-term portfolio building

This diverse selection ensures that participants gain exposure to different market segments and investment vehicles, preparing them for real-world portfolio management.

Trading Strategies for Success in India Stock Challenge 📊

Fundamental Analysis Approach

Successful participants in the India Stock Challenge often employ rigorous fundamental analysis. This involves evaluating company financials, industry position, management quality, and economic factors affecting stock performance.

Key fundamental metrics incorporated in the India Stock Challenge platform include P/E ratios, P/B ratios, debt-to-equity ratios, revenue growth, and profit margins. Users can access detailed company financials directly within the game interface.

💼 Pro Tip:Combine fundamental analysis with technical indicators for a comprehensive trading approach in the India Stock Challenge.

Technical Analysis Techniques

The India Stock Challenge provides extensive technical analysis tools including:

- Multiple chart types (candlestick, line, bar, Heikin-Ashi)

- Over 50 technical indicators (Moving Averages, RSI, MACD, Bollinger Bands)

- Drawing tools for trend lines, Fibonacci retracements, and support/resistance levels

- Pattern recognition for common chart formations

Mastering these tools within the India Stock Challenge environment can significantly improve trading decisions and market timing.

Risk Management Principles

The India Stock Challenge emphasizes proper risk management through:

- Position sizing calculators

- Portfolio correlation analysis

- Volatility-adjusted position limits

- Scenario analysis tools

These features help participants develop disciplined trading habits that protect capital during market downturns while maximizing returns during favorable conditions.

Educational Benefits of India Stock Challenge 🎓

Practical Financial Literacy

The India Stock Challenge transforms abstract financial concepts into tangible experiences. Users learn about market mechanics, order types, portfolio construction, and risk assessment through hands-on practice.

This experiential learning approach has proven more effective than traditional classroom instruction for developing practical investment skills. Participants report increased confidence in making real investment decisions after completing the India Stock Challenge program.

📈 Skill Development:Regular participation in India Stock Challenge improves analytical thinking, decision-making under uncertainty, and emotional control during market volatility.

Career Advancement Opportunities

Many financial institutions recognize India Stock Challenge participation as valuable experience for entry-level positions. Top performers often receive internship offers and job interviews based on their demonstrated trading proficiency.

The platform's certification program provides credible validation of trading skills that can enhance resumes and professional profiles in the finance industry.

Behavioral Finance Insights

The India Stock Challenge includes features that help users identify and overcome common psychological biases such as:

- Overconfidence in trading decisions

- Loss aversion leading to premature profit-taking

- Herding behavior during market extremes

- Anchoring to purchase prices

By recognizing these patterns in their simulated trading, participants can develop strategies to mitigate their impact on real investment decisions.

Community & Competitions 👥

Monthly Trading Championships

The India Stock Challenge hosts regular competitions with attractive prizes for top performers. These events attract thousands of participants and create intense but friendly competition.

Championship formats vary from rapid-fire day trading contests to longer-term portfolio management challenges, testing different skill sets and strategic approaches.

🏆 Championship Structure:Monthly tournaments feature qualification rounds, semi-finals, and grand finals with live streaming of top traders' strategies.

Knowledge Sharing Ecosystem

The India Stock Challenge community platform facilitates knowledge exchange through:

- Strategy discussion forums

- Expert webinars and AMA sessions

- Peer-to-peer mentoring programs

- Educational content created by top performers

This collaborative environment accelerates learning and helps participants avoid common pitfalls in their trading journey.

Corporate and Educational Partnerships

The India Stock Challenge has established partnerships with universities, financial institutions, and corporations to promote financial literacy. These collaborations include:

- Campus trading competitions

- Corporate training programs

- Financial literacy workshops

- Research initiatives on trading behavior

These partnerships expand the reach and impact of the India Stock Challenge while creating valuable networking opportunities for participants.

Future Developments of India Stock Challenge 🚀

Technological Enhancements

The development team behind India Stock Challenge is continuously working on platform improvements including:

- AI-powered trading assistants

- Enhanced mobile experience with advanced charting

- Virtual reality trading environments

- Blockchain integration for transparent competition records

These innovations will further bridge the gap between simulation and real trading while providing more engaging user experiences.

🔮 Vision:India Stock Challenge aims to become the premier global platform for stock market education through continuous innovation and user-centric design.

Expanded Market Coverage

Future versions of India Stock Challenge will include:

- International market simulation

- Cryptocurrency trading modules

- Commodities and forex markets

- Fixed income securities

This expanded coverage will provide participants with comprehensive exposure to global financial markets within a single platform.

Educational Curriculum Development

The India Stock Challenge is developing structured learning paths with certification at various competency levels:

- Beginner investor certification

- Advanced technical analyst program

- Portfolio management specialist track

- Derivatives trading mastery course

These formal educational components will complement the practical trading experience, creating a holistic financial education platform.